Vimeo's Perception Transformation

From Video Host to Enterprise Player – The Re-Rating Opportunity

If you haven’t explored the genius of Robert Wilson, you’re in for a treasure trove of insights. Often overlooked, he was one of history’s greatest investors, yet his name doesn’t come up nearly as often as it should. Though we never met, his approach has profoundly shaped my own investment strategy and thinking.

Wilson turned a modest $15,000 into over $200 million through a long/short personal account, eventually amassing gains exceeding $800 million before his passing.

His edge? A deep understanding of perception in markets—positioning himself not where the crowd was, but where it was about to go. Much like Wayne Gretzky skated to where the puck was headed, Wilson anticipated shifts in market sentiment before they became obvious.

One of his most powerful lessons can be summed up in his own words:

'The only way one makes money in the market is when the market’s perception of a stock changes.'

And that brings us to Vimeo. I believe we have a compelling investment case for a perception shift that the market has yet to recognize. The re-rating of Vimeo as a true enterprise SaaS company could unlock substantial upside, and right now, we’re ahead of the crowd

Vimeo (VMEO) Investment Analysis

Company Description

Vimeo is a global video hosting, sharing, and services platform focused on businesses and professional users. It provides video creation, editing, hosting, and distribution tools with features such as AI-powered video transcription, translation, and security-focused enterprise video solutions. The company serves individual creators, streaming businesses, and large enterprises, with a growing focus on its Vimeo Enterprise SaaS business (this is the perception change I am talking about)

Enterprise Revenue & Bookings Growth

Revenue Trends

Bookings Trends

Key Takeaways:

Enterprise now contributes over 22% of Vimeo's revenue and nearly 30% of its bookings. This is a major shift in Vimeo’s business model, moving away from individual content creators toward high-value corporate clients.

Enterprise revenue consistently grows 37-60% YoY. The segment is expanding rapidly and outperforming the rest of the company.

Annualized bookings have exceeded $100M for two consecutive quarters (Q3 & Q4 2024), making Enterprise the dominant segment.

Key Customer Wins & Expansion Trends

Vimeo Enterprise has successfully attracted major corporations across various industries. Some of the most notable deals include:

Takeaways:

Enterprise customers include some of the largest brands in the world, validating Vimeo’s premium SaaS product.

Expansion into e-learning, healthcare, and financial services is key, as these industries require high-security video hosting solutions.

Corporate training and internal video communication are driving adoption—many companies use Vimeo for leadership messaging, all-hands meetings, and compliance training.

Key Growth Drivers in Enterprise Expansion

AI-Powered Features Enhancing Value Proposition

Vimeo is leveraging AI to differentiate itself from competitors by introducing new features tailored for enterprises:

Automated Video Transcription & Captioning – Enhances accessibility and compliance.

AI-Powered Translation in 28+ Languages – Expands global reach, particularly useful for multinational corporations.

Social Media Clip Generation – Automates marketing content creation.

Knowledge Extraction through AI – Helps enterprises index, categorize, and retrieve key video content efficiently.

Secure Video Streaming & Content Protection – Essential for industries like finance and healthcare.

These features enhance productivity, reduce video production costs, and improve compliance with corporate security policies, making Vimeo a sticky enterprise product.

Expansion into China and Global Market Growth

In Q3 2024, Vimeo opened enterprise video distribution in China, a significant move given China’s restrictive video-sharing environment.

Over 45% of revenue now comes from international markets.

Potential for further expansion in Asia, Europe, and Latin America, particularly in corporate training and compliance-related video hosting.

Higher Pricing & ARPU Expansion

ARPU has steadily increased, reaching ~$23.5K per customer due to feature upgrades and expanded services.

40% of Enterprise customers expanded their spend beyond the standard 7% annual price increase, indicating strong retention and willingness to pay more.

Will The Perception Change?

For this analysis, I want to focus on Price to Sales and try to identify why Vimeo trades at the multiple it does now, and can it change to trade more in line with Enterprise Software peers.

Current Price-to-Sales (P/S) Ratio for Vimeo

Current P/S Ratio: ~2.33x

Current Market Cap: ~$972 million (based on $5.89 stock price and 165M shares)

2024 Revenue: ~$417 million

Why is Vimeo Trading at a Low P/S Ratio?

Vimeo’s 2.33x P/S ratio is significantly lower than many enterprise SaaS companies that trade between 4x-8x. Here’s why:

1) Perception as a "Consumer-Oriented" Video Platform

Legacy Perception: Despite its enterprise push, Vimeo is still widely perceived as a consumer video hosting platform rather than a true enterprise SaaS business like Zoom, Salesforce, or Adobe.

Self-Serve Struggles: The declining Self-Serve & Add-Ons segment (~1.2M individual users) creates an overhang on the stock, as it still makes up a significant portion of revenue (~65%).

2) Low Revenue Growth (~5% Total, Despite Strong Enterprise Growth)

Vimeo's total revenue is nearly flat YoY, which is unattractive for high-growth SaaS investors.

While Enterprise is growing 40%+ YoY, the Self-Serve business is shrinking (~6-10% declines).

Investors may be waiting for overall revenue growth to accelerate before assigning a higher P/S multiple.

3) Profitability Still in Transition

Vimeo has positive EBITDA (~$11M in Q4 2024) but is still not meaningfully profitable.

Many SaaS companies with high P/S ratios are either highly profitable (Adobe) or growing 30%+ annually (HubSpot, Snowflake).

Vimeo’s 8% projected net margins are improving, but SaaS investors prefer 15%+ margins for premium valuations.

4) Lack of Recurring Revenue Perception

Investors may not fully recognize Vimeo as a high-recurring-revenue SaaS model, unlike Zoom or Dropbox.

Despite strong Enterprise subscription growth (~4,000 customers, $100M+ bookings), it’s still a smaller part of the business (~22% of revenue).

If Enterprise reaches 50%+ of revenue, it could justify a P/S re-rating.

5) Lack of Clear Market Dominance

Competition from YouTube, Microsoft Stream, Brightcove, and Zoom means Vimeo doesn’t dominate its industry.

Lack of a unique moat—other than its AI-powered enterprise features and security focus—keeps a lid on its valuation.

Key Takeaway: Why Could Vimeo's P/S Ratio Increase?

If Vimeo continues its Enterprise pivot and achieves:

Sustained 30-40% YoY growth in Enterprise revenue.

Total revenue acceleration from ~5% to 10-15% YoY.

Stronger profitability (EBITDA margins above 15%).

A clearer SaaS positioning with higher ARPU & retention.

Then Vimeo could re-rate towards a 5x-8x P/S multiple, pushing the stock towards $15-$23 over the next few years.

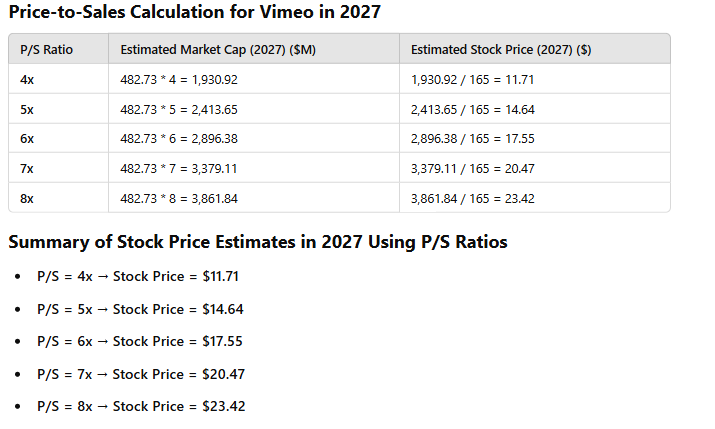

Price-to-Sales (P/S) Ratio Analysis for Vimeo in 2027

To estimate Vimeo’s stock price in 2027 using a Price-to-Sales (P/S) ratio, I will project based on a range of potential P/S ratios for SaaS companies. Since Vimeo's growth prospects align more with enterprise SaaS, it could be re-rated similar to other enterprise software companies.

Step 1: Estimate the 2027 Total Revenue for Vimeo

From our prior model:

2027 Total Revenue is projected to be $482.73 million.

Step 2: Apply Various P/S Ratios

Let's look at the range of P/S ratios for enterprise SaaS companies that have solid growth. We will compare Vimeo to other SaaS peers such as Salesforce (CRM), HubSpot (HUBS), and Adobe (ADBE), which have historically traded at higher P/S ratios due to their strong enterprise presence and growth.

Here’s a rough estimate of their current P/S ratios:

Salesforce (CRM): ~7x

HubSpot (HUBS): ~9x

Adobe (ADBE): ~11x

Given Vimeo's growth prospects in the Enterprise segment, we will apply a range of P/S ratios between 4x to 8x, with the higher end representing a more optimistic re-rating as a true enterprise software company.

Step 3: Calculate Stock Price in 2027 Using P/S Ratios

We'll calculate Vimeo's market cap at different P/S ratios and then estimate the stock price using the number of shares outstanding.

While trading at 8x sales is a tough ask, even with modest growth and success pushing their enterprise segment, if VMEO starts to get re-rated as a true enterprise player, this could be a double or triple in the next 2-3 years.

And while not financially meaningful, after the recent drop on earnings on 2/20, the Chief Executive Officer, Chief Financial Officer, Chief Product & Tech Officer, and one (1) Director bought 65,791 shares combined worth approximately $353K.

Maybe they see something everyone is missing?

Maybe they are betting on the perception of VMEO changing, and along with it the re-rating towards an enterprise software company?

—NS