Stoneridge, Inc. (SRI) - Valuation & Growth Prospects Analysis

Deep value with strong growth drivers?

Current Price: $5.64

Market Cap: ~$156M

Sector: Auto Components (Commercial & Off-Highway Vehicles)

Stoneridge, Inc. presents a deep value opportunity with strong growth potential, especially in its MirrorEye® digital vision system. Below is a detailed valuation breakdown and growth outlook for the company.

1) Valuation Breakdown: How Cheap Is SRI?

At its current price of $5.64, SRI trades at a deep discount relative to both historical valuations and sector peers.

What This Means:

SRI is trading at only ~17% of sales, meaning the market is deeply discounting its revenue base.

P/B ratio of 0.63x suggests that the market is valuing the company below its tangible assets, which is a strong indicator of a value play.

EV/EBITDA of 4.1x is well below the industry average of 8.5x, meaning the market is significantly undervaluing its operating earnings.

🛑 This signals that the market is not pricing in the company’s future growth potential, especially from MirrorEye’s expansion.

2) Growth Prospects – Where Is the Upside?

Despite weak historical financials, MirrorEye and other tech innovations are set to transform the company.

🔹 MirrorEye® - The Key Growth Driver

What Is It?

MirrorEye is a digital camera-based mirror replacement system that improves fuel efficiency, visibility, and safety for commercial vehicles.

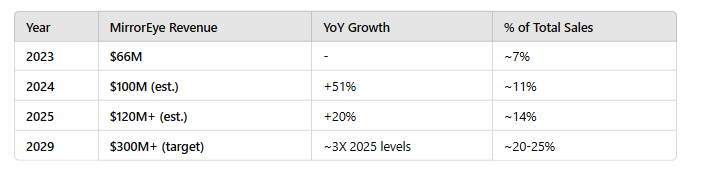

MirrorEye Revenue Growth Targets

🚀 Key Takeaways:

MirrorEye is expected to double from 2023 to 2025.

Targeting $300M+ in revenue by 2029, a 3X increase from 2025.

Could become ~20-25% of Stoneridge’s total revenue mix by 2029.

📌 Major catalysts driving MirrorEye growth:

Regulatory Tailwinds:

EU mandates digital mirrors for trucks starting in 2025.

U.S. FMCSA already approved MirrorEye, paving the way for wider adoption.

Fleet & OEM Adoption:

Partnering with major North American and European truck manufacturers.

Retrofit solutions for existing fleets create a secondary revenue stream.

Competitive Advantage:

First-to-market advantage in the digital vision space.

Superior safety and fuel efficiency gains drive adoption.

Expansion Beyond MirrorEye – Additional Growth Levers

1️⃣ Connected Trailer Technology (Launching 2025)

New suite of products improving trailer connectivity for logistics and safety.

Key fleet partnerships in place, potential multi-billion-dollar market.

2️⃣ SMART 2 Tachograph System (83% YoY Growth)

Regulatory mandates in Europe for digital tachographs.

Already added ~$27M in incremental revenue in 2024.

3️⃣ Cost Structure & Operational Efficiency Improvements

2024 Free Cash Flow: $23.8M (vs. -$31.7M in 2023) – strong turnaround.

Inventory reduced by $36.4M, freeing up liquidity.

Targeting 7.2% EBITDA margin by 2026, up from 4.2% in 2024.

3) Long-Term Financial Projections

Stoneridge has set ambitious long-term targets:

2025 Revenue & Profitability Targets

Revenue: $860M - $890M

EBITDA: $38M - $42M (4.4% - 4.7% margin)

MirrorEye Revenue: $120M+ (double 2023)

2026 Target

Revenue: $975M+

EBITDA: $70M+ (7.2% margin)

2029 Target

Revenue: $1.3B - $1.45B

EBITDA: $160M - $200M (12.3% - 13.8% margin)

📈 Stoneridge expects to nearly double revenue & 5X EBITDA by 2029.

4) Risks – What Could Go Wrong?

🔻 Execution Risk:

MirrorEye adoption must scale quickly to hit revenue targets.

OEM partnerships must convert into large-scale orders.

🔻 Competitive Landscape:

More players could enter digital mirror & connected vehicle tech.

🔻 Short-Term Market Volatility:

Stock may stay undervalued until profitability is visible (2026+).

5) Price Target – What’s the Fair Value?

If Stoneridge executes on MirrorEye & cost improvements, the stock should re-rate higher.

Valuation Scenarios

📌 At industry-average multiples, SRI could trade between $15-$20, implying a ~3X return.

📌 If MirrorEye fully scales, a 5X return ($25+) is possible.

6) Final Verdict:

✅ Deep Value Today, Growth Powerhouse Tomorrow

✅ Market is Mispricing MirrorEye’s Potential

✅ 2X-3X upside potential by 2026; 5X potential by 2029

💡 Investment Case:

Stoneridge is a rare mix of a deep value stock with a high-growth business inside it (MirrorEye). The market is sleeping on this story. If they execute, this stock could explode in the coming years

—NS