As you may know, I love event driven investing. A lot of that is on the back of strong themes and emerging stories. A great place to start is names reporting strong earnings and sales that are being bought by the market. I am toying with the idea of daily (maybe) updates on themes, earnings, and stories.

Please let me know if you would like more of this.

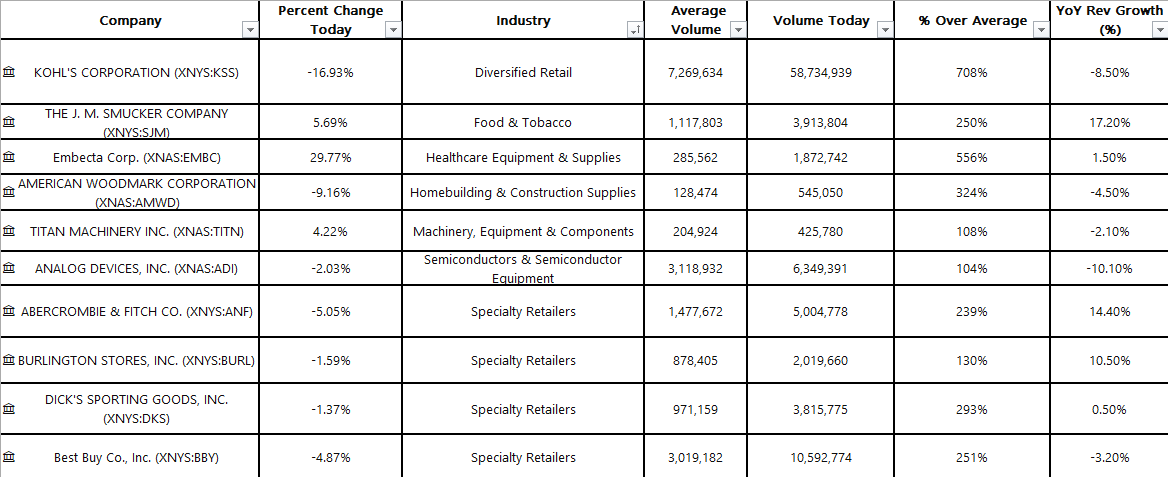

Earnings Before Market Open Today

Not a whole lot in the premarket. ANF BURL DKS and BBY on the retailers side, all down in todays session. KSS really took a beating, down almost 17% on 700% of normal volume. The strongest revenue growth was from SJM while the best performing name was EMBC on 556% of normal volume, but anemic 1.5% revenue growth. As we can see, the market did not like the retail reports.

After Market Close

AMBA appears to be the only real positive one moving higher in after hours. A lot can happen between now and the close tomorrow, but at least we have time to investigate names that look interesting. With 63% revenue growth and a strong initial move higher, it warrants a look and possible add to watch list.

WDAY CRWD DELL and ADSK all lower on earnings.

Spotlight Idea

Doximity Inc (DOCS)

DOCS had a strong gap up but failed. Today, it showed strong price action off a key weekly level (below) on heavy volume. Todays move of just under 10% is large, and makes it hard to get positioned if not already buying today.

After a long multi-year base, DOCS broke out on heavy volume and pulled back into support. Todays bounce could be the start of a move higher.

(disc- I am long DOCS)

These are the setups I hope to share more of on the back of the above information. Names making strong moves, setting up off pullbacks or consolidations, with strong top line growth and large TAMs.

I hope to share some information with you, and you can start building out watchlists and trying to get positioned in these market leading names. Below is a list of notable growth names that are on my universal growth watchlist. These are not all the names, but just some.

Notable Growth Leaders (from Briefing.com)

DAVE, INOD, CDXC, XMTR, WGS, USLM, DSP, AGX, BILL, ELMD, PAYO, CRNT, MCS, AVPT, HIMS, SMWB, UTI, WRBY, BYRN, CORT, ZG, RDVT, AMSC, RELY, CRDO, AIOT, TILE, OLO, UPWK, QTWO, VERX, DXPE, GDYN, CNX, SITM, INTA, VCYT, INFU, CRS, GAMB, POWL, GTLS, CWAN, ADMA, CFLT, REZI, RSI, SKYW, AUPH, NEXN, PWP, DOCS, GRRR, LRN, CEVA, GENI, NGS, FRSH, GVA, LYFT, LOAR, CALM, PIPR, PYCR, LINC, CSWI, CVCO, ALKT, GTLB, FLYW, EXLS, AGYS, SYM, ACIW, NCNO, AWI, WEAV, TGNA, CTLP, STEP, DRS, AGIO, ACVA, BWAY, ARQ, HQY, ATGE, JBT, MTSI, MWA, GLDD, PEN, CVLT, SKY, QNST, RAIL, ODD, CRGY, LMAT, S, AS

One note on INOD, I did notice a considerable amount of chatter about this name. I want to include a write up from Briefing.com below, and take note that 57% of their sales comes from one client, who they do not name. To me, that is a red flag, but interesting story nonetheless.

“Innodata is a data engineering firm focused on delivering high-performance AI. The company delivers data for tech companies to train AI models. Given its considerable exposure to AI, INOD has exploded in 2024. Much of its over +480% appreciation came after the company's Q3 report earlier this month. The company enjoyed superb business momentum in the quarter, delivering 136% yr/yr revenue growth, strong margin expansion, and broadening customer relationships. As a result, the company hiked its FY24 guidance. Management expressed excitement over its strategic roadmap, focusing on providing big tech firms with the data engineering required to develop Gen AI models. However, aside from the risks related to any cooldown in AI demand, INOD is highly dependent on a few customers. For instance, in Q3, it generated 57% of its sales from one tech firm. INOD did not disclose who this was, but if AI returns struggle to overcome the massive spending by tech companies to bolster their AI infrastructure, this well could dry up rapidly, causing shares to sell off. Still, there have been few signs of any slowdown in the AI space. Unless this occurs, INOD is well-positioned to continue enjoying outsized quarterly growth.”

—NS