Bigger The Base, Higher In Space?

Big Bases, High Spaces and Building Pyramids with $FLEX $SANM $FN

Information is from Marketsmith (investors.com) and company websites.

There is an old adage in trading : “The bigger the base, the higher in space”.

Meaning when a stock breaks out of a big and long base, it has the potential to move significantly higher.

When several stocks in the same group break out of long bases during a nasty bear market, that is something to pay attention to. Especially when those stocks are not defensive in nature and putting in consecutive quarters of top and bottom line growth.

I am referring to the electrical contract manufacturing group. Although the group as a whole (in Marketsmith) appears to have below its pivot and previous breakout zone, several stocks in the group are above their pivots and approaching the breakout zones. I want to watch these closely to see if they bounce and try to go higher, or fail and fall back in their bases.

The names I want to look at are:

Flex LTD ($FLEX)

Sanmina Corp (SANM)

Fabrinet ($FN)

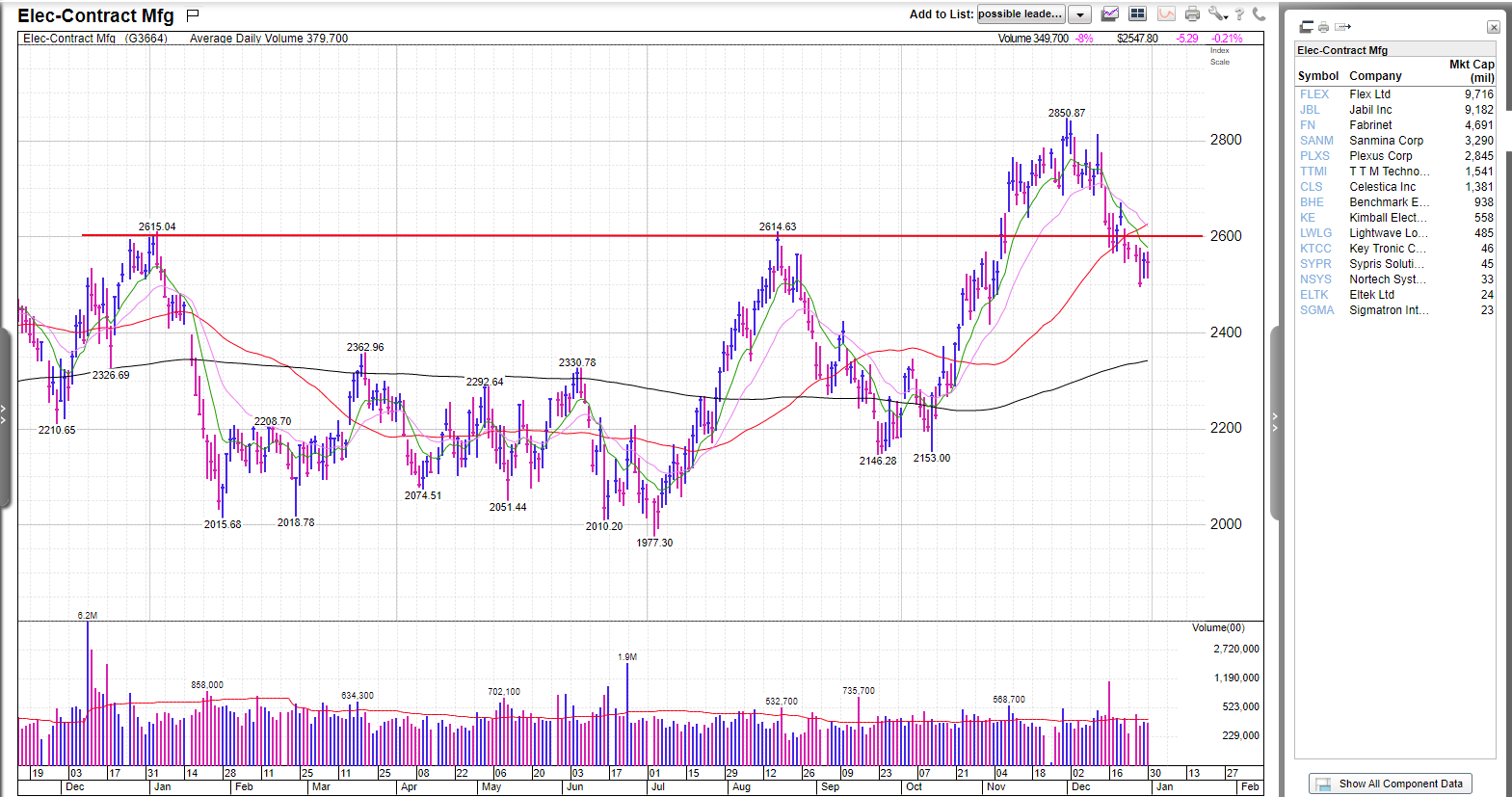

Group Action

The group broke out when the overall markets rallied from October into November of last year. It is not a great sign that price is back below the key pivot level of 2600. However, as long as the leaders hold their breakout zones, this is a key group to watch.

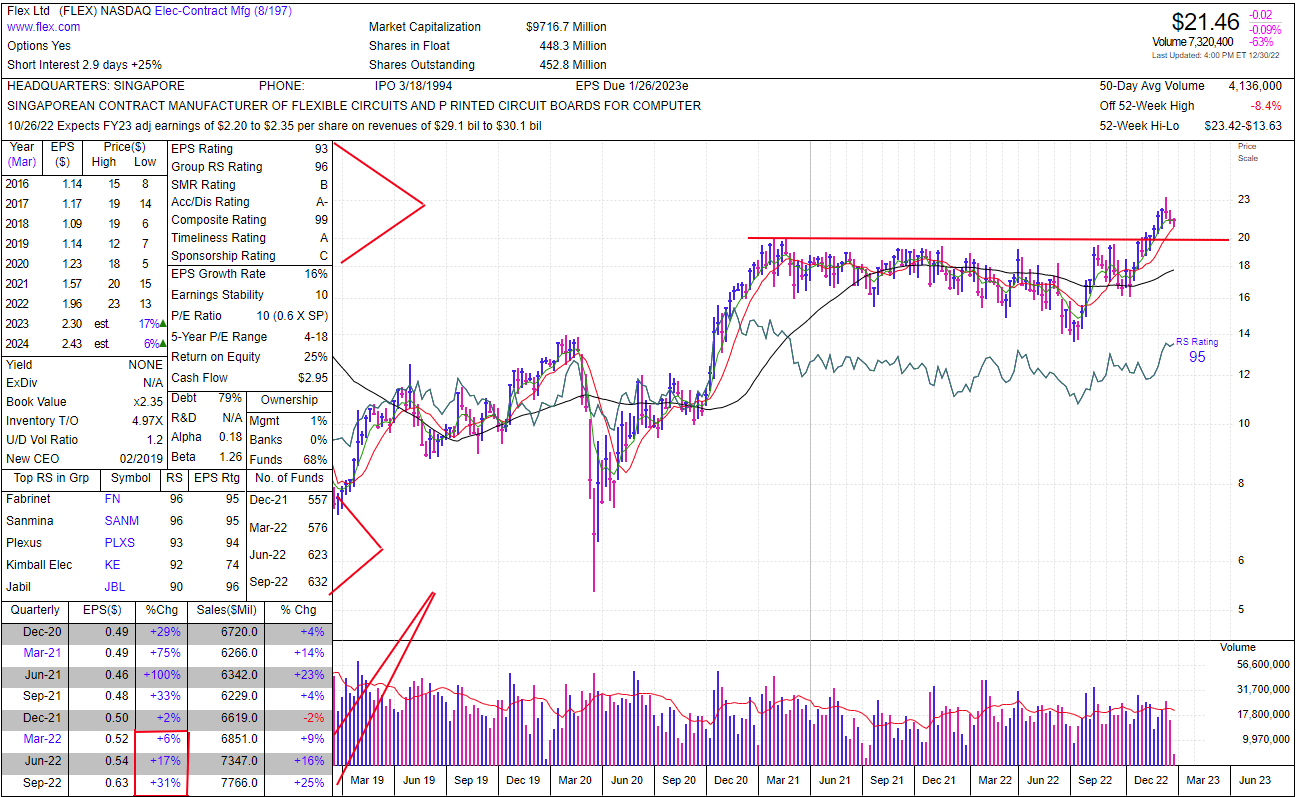

Flex ($FLEX)

Flex broke out of a two year long base in November of last year. The pullback has been orderly so far as price is now trying to bounce off the rising 10-week simple moving average. As long as price stays above the 10week average and the 20.00 breakout pivot, I would be watching for entry signals.

Fundamentally speaking, I like the consecutive quarters of top and bottom line growth. A strong group ranking and composite of 99 with a accumulation/distribution rating of A- hints this name is in demand.

On the daily chart above, I would like to see price hold the 21.00-20.50 level, create a little cheat pivot to start a position on and then add if it gets through 22.00. It is too early for me to do anything here but I will be watching it closely.

Sanmina ($SANM)

This appears to be the leader in the group. It broke out first, back-tested the breakout pivot and raced higher, almost doubling. However, I was hoping for a better overall reaction after their earnings in November. The stock gapped higher, traded sideways but then it has started to move significantly lower.

They specialize in integrated manufacturing solutions for high tech OEM’s in the communications, cloud computing, industrial, medical, automotive, defense and aerospace industries. Their technology includes (not limited too) printed circuit boards, backplanes, cables, SSD and DRAM, optical and RF microelectronics, precision machining, enclosures and precision welded frames along with injection molded plastics and assembly services. They do this in 6 continents and 20 countries with facilities in Europe, Asia and the Americas.

However, with 3qrts of accelerating earnings and sales and the leadership potential of this name, don’t give up on it yet.

There is not much to do on the daily chart on $SANM. I want to see it firm up and ideally get back above the 21ema (red line) before thinking about taking a position. I would be inclined to start a piliot position if it could hold around 56-58 and form a little bottom base cheat pivot.

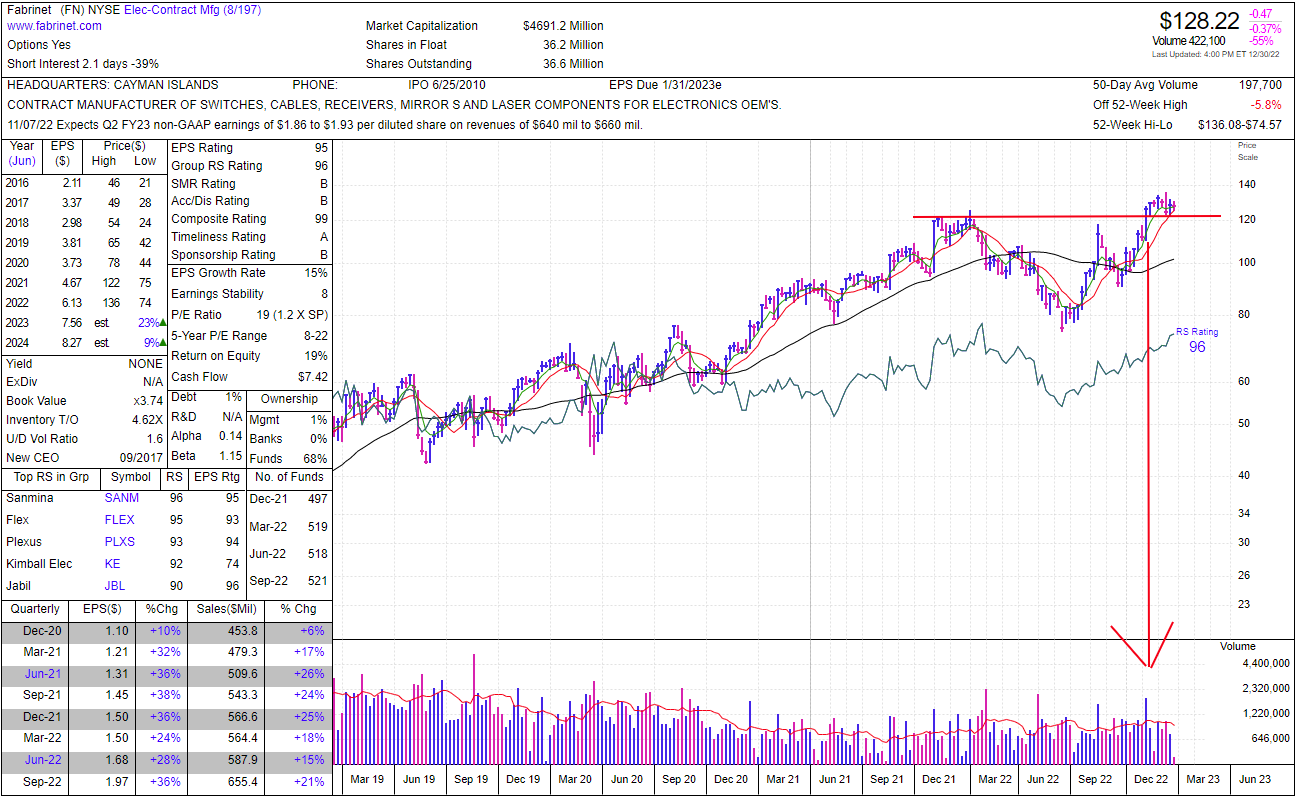

Fabrinet ($FN)

Based in the Cayman Islands, you can argue $FN is the cleanest setup in the group. A high volume breakout on earnings should have alerted you to this name. It moved higher, although in choppy fashion, and is holding up very well as overall market weakness is present. Also, it already back-tested the breakout pivot and held. This is a very constructive sign.

On the daily chart below you can see several constructive elements. The back-test and bounce is seen, along with the 50 day simple moving average (blue line) starting to close the gap. The relative strength line is at highs and price is starting to get really tight. The risk reward is starting to look favorable for long trade.

Personally (and this is not investment advice) I would place a stop below the 50 day simple moving average and see what happens. A pilot position would be a good idea, maybe allocating 50% of your total position with the idea of adding if price can get above 136.00 and confirms the back test was a valid signal.

Wrapping it up

Jesse Livermore was a big fan of studying group action and taking “exploratory bets” in names that are breaking out and trending. He would pyramid into names as they went higher. Darvas also employed this method. As did Bill O’Neil.

It allows you to play with house money. If the exploratory bet works and shows a profit, you know you are right. You can add more (being careful not to run up your average cost too much) with the comfort of a profit cushion. You then let the trade work, either adding more ( if you want to be really aggressive), trimming some off or just moving up your trailing stop as Darvas was a fan of.

As these names are thinner and tend to be choppy, they are not fit for a tactical trade where I trim some off and leave a runner. I want to be more careful and strategic, trying to get a cushion quickly and seeing if they do, indeed, want to go higher in space.

—NS