What is Aris Water Solutions? From there website at — https://ir.ariswater.com/— They describe themselves as follows:

“We are a leading, growth-oriented environmental infrastructure and solutions company that directly helps our customers reduce their water and carbon footprints. Our integrated pipelines and related infrastructure creates long-term value by delivering high-capacity, comprehensive produced water management, recycling and supply solutions to operators in the core areas of the Permian Basin.”

NOTE- ConocoPhillips owns 24% and also accounts for 34% of ARIS 1Q 2022 revenue. I have to imagine that portion of revenue will be stable as ConocoPhillips will continue to use ARIS for their water management needs as they have a vested interest in them.

Full Cycle Water Management

By the Numbers

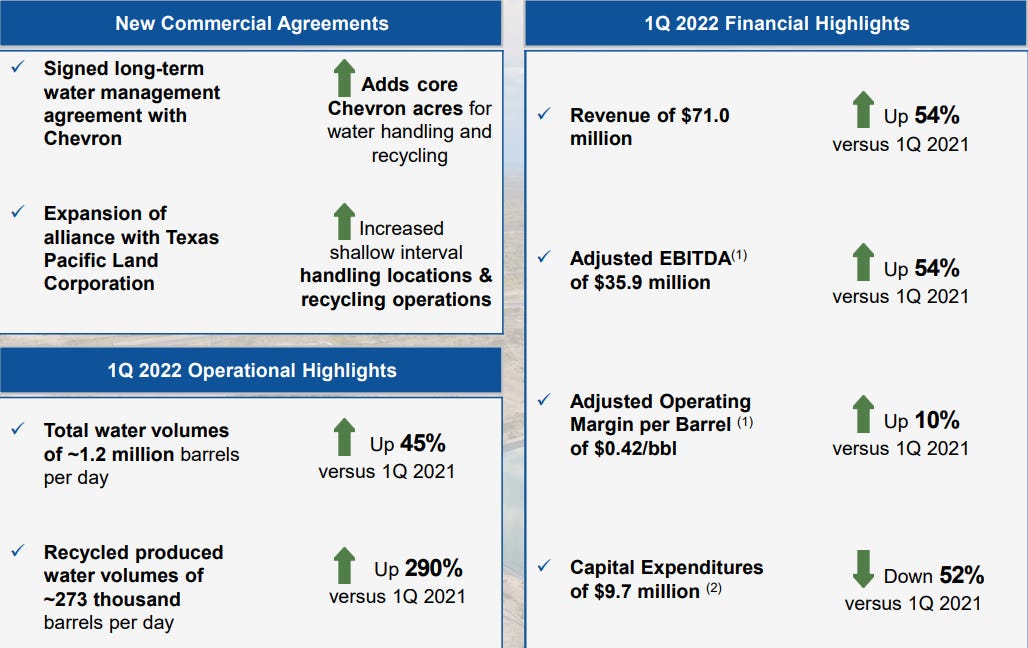

As we can see with their increased water volumes (up 45%) , growing volume profile, new partnerships (Chevron) and expansion with existing customers (Texas Pacific Land Corp), Aris is growing revenues at 54% (Q/Q).

Future Growth Plans

It appears Aris is not only focusing on the oil and gas industry, but looking for ways to expand into new business/revenue channels.

To the Charts

Aris is a recent IPO name showing accumulation and relative strength during general market weakness. While it is true many Oilers and energy names have been showing strength and working (really the only sector that has been lately) I really like the technical action of ARIS. With a composite rating of 95 and U/D Volume ratio of 1.5 (strong) ARIS broke out of its recent pivot high around 19.50 on 5/27 on 778% on normal volume, very heavy and strong. I always pay attention to names with increasing fund ownership and 3 consecutive qtrs. of sales growth making new highs on increased volume (demand) during market corrections.

Conclusion:

As long as ARIS can hold its recent breakout pivot, I believe its worth your attention. There might not be a resource more vital to life than water. It also appears we are at an intersection of possibly needing more domestic oil production (current geo-political/ war) and a developing water shortage (remember seeing those pictures of lake Mead?). ARIS is positioned to benefit by both tailwinds.

As always, do your own research and make your own decisions, but don’t forget about this little IPO name making waves in the water market.