Welcome back to Bullish Growth Stocks for year two!

2022 was a tough year. The Dow Jones retreated 8.8%, the S&P 500 slumped 19.4% and the Nasdaq fell 33.1%, logging their worst annual performances since 2008. Growth stocks slumped, breakouts failed and markets were volatile as participants hanged on every piece of inflation data and each sentence Jerome Powell uttered. The Nasdaq tried to rally around 5 times, putting in gains of 10-25% off the lows. But each time was followed by a subsequent retracement and lower lows.

The buy and holders didn’t fair much better with the standard 60/40 portfolio having one of the worst years in history, down around 16%.

Charles Harris from IBD called it a “stay away year”. And he is one of the best in the game.

Even as calendars flip into the new year, we will still write 2022 for a couple of weeks. And as the old year stays in our minds, I am planning for the hangover in markets to persist as well. We will be ready WHEN the markets confirm a new uptrend. But I am planning on playing this year much more tactically.

There were bull markets to be had last year. Energy put in several strong tradeable trends. Now, it appears pharma/biotech’s are trying to do the same (more on that soon). Look at investors.com 100 best performing stocks from last year (found here) and see if they setup in your style. We actually did trade in some of them. We also missed a lot to. So here’s to a better 2023!

Lets start at the top

The SP500 (along with IWM QQQ IWO) is below all key moving averages, a downward slopping 200 day simple average and still putting in a downward trend in price. The DOW is the only major index bucking the trend right now. But as I have highlighted previously, there are reasons to worry about the last index standing. The picture does not look good (but can change at any moment). Until price can get above the 21ema (the red line) I am assuming the downtrend is in full force. Proceed with caution to start the new year is my default. Right now, the market is guilty until proven innocent.

The only problem is… There are some really good setups right now.

IBD Top Groups

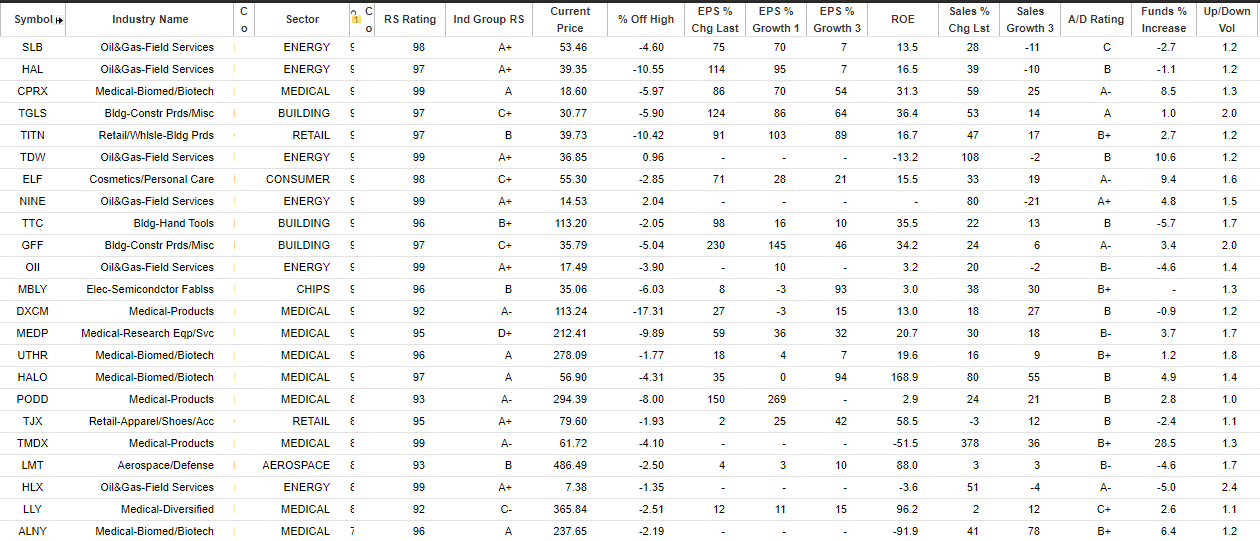

The top group coming into the year is Oil and Gas field services ( you can play the group through OIH or XES). And on the whole, it looks good.

The 230 level as been a strong pivot point for a couple of years now. The group as a whole looks to be primed to breakout above this level. The top names in the group look very good.

The two most well known names are Schlumberger (SLB) and Halliburton (HAL). Both are right under key pivot points as leaders NINE and TDW continue to work higher after breaking out.

This group is a high focus area for me to start the year. I want to see how the leaders react and possibly jump on board a constructive pullback and/or pick up HAL and/SLB on confirmed breakouts.

Setups!

Primary List- CPRX ALNY AXSM ELF LLY LMT MBLY TGLS TJX TTC TMDX UTHR SLB

Catalyst Pharma (CPRX)

There is not a lot to dislike with Catalyst Pharma. Price is in a strong uptrend on the weekly chart, top 25 IBD group, very strong top and bottom line growth, increasing number of funds buying it, strong estimates and a composite rating of 99.

Price broke out originally around the 8 dollar level, trended higher and put in another base recently. Price broke out again on 12/21 and put in a low volume pullback to test the breakout pivot. A nice bounce bar on Friday allowed us to add (originally bought on breakout). As long as price holds above 18, this is my favorite long idea right now and one I hope you are already in.

Transmedics Group (TMDX)

Another solid trending name that broke out of a cheat pivot on Friday. I took a pilot position here and will add if it works higher. I don’t think it is too late to jump on board this one and one.

Rounding out my top watchlist for next week is (Charts Below)

ALNY- Another strong trending name consolidating right under its highs

ELF- One of the biggest winners from last year might need some more time to tighten up but is a buy through its pivot

LMT- NOC looks equally as good and I would be a buyer through the pivot

TJX- Strong trending name with a clean cheat pivot to play a trend continuation.

TGLS- I don’t know what is going on here, but the accumulation volume is very… very strong….

UTHR- Another pharma name trying to break higher.

Secondary names

HALO- Getting tight near highs and holding recent lows well. Looking for a break above the DTL or for a cheat pivot to form

PODD and DXCM- Both holding recent gap ups and looking similar

GFF- Fundamentally strong name putting in a base on base. Needs to tighten up and form a clean pivot but one I am watching to see if I can get in

MEDP- Another gapper holding well. Nice cheat pivot around the 220 level

TITN- Gapped up, tested the lows and held. Broke a DTL and 3 days of tight action formed a clean pivot. I will be a buyer through the 40.50 level.

Below is some fundamental data for all the names I talked about above

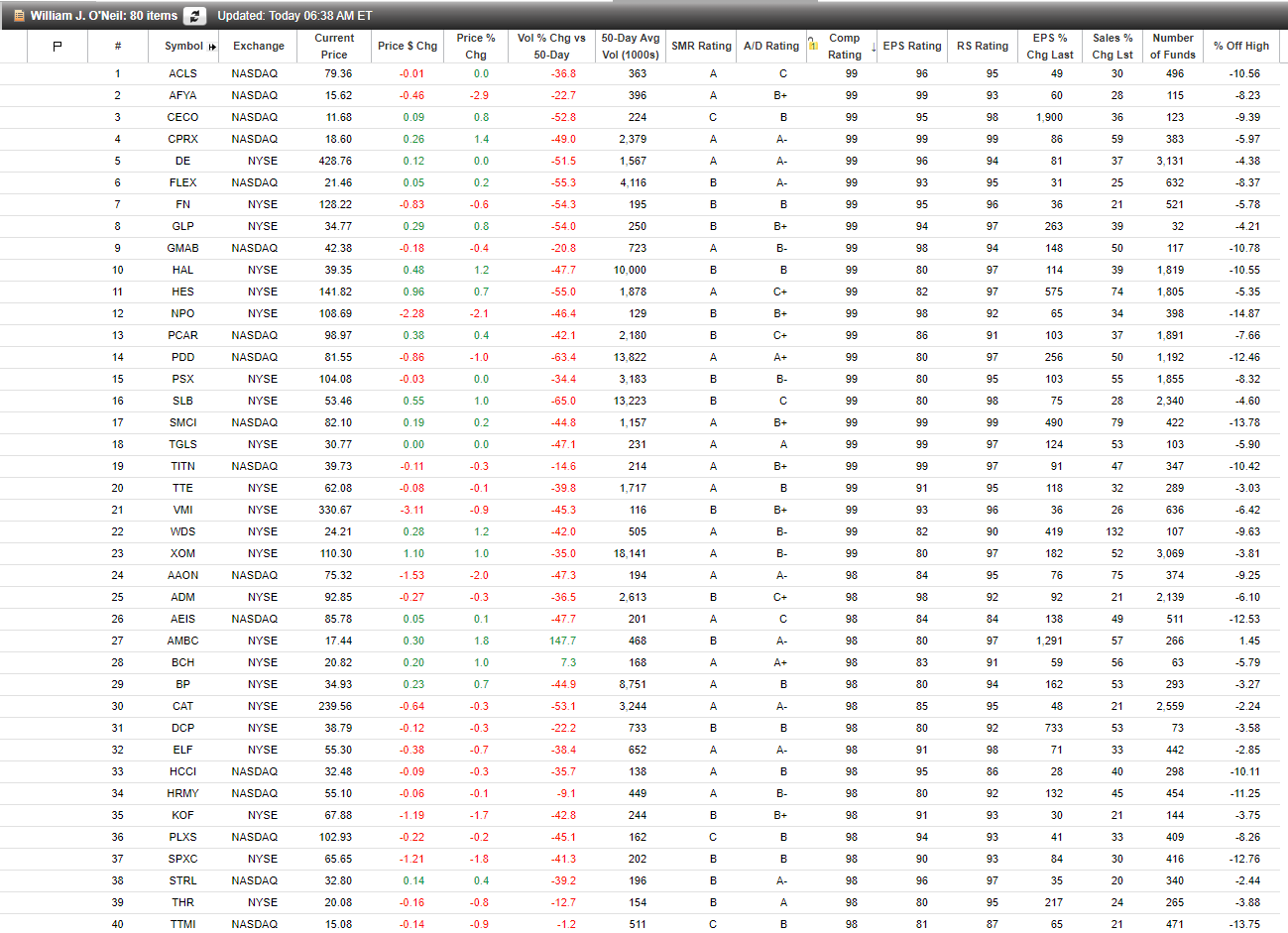

Scans!

Below is the Marketsmith screen for William J O’Neil. It is sorted by composite rating (high to low). You will see a lot of overlap between the names I showed and what appears on his fundamental CANSLIM screen. Below are the top 40 names

Accelerating Sales

Something I noticed about last year were some of the biggest winners had 3qtrs of accelerating sales BEFORE they broke out and ran. Look at the IBD list of top 100 stocks of 2022 that I linked above. STNG and ELF are two standouts, along with INSW and many others. Below is a screen focusing on 3qtrs of accelerating sales, market cap over 500 million and price above 10 dollars. There are currently 510 names on this list. I bet you there is a monster somewhere in there. If you want the full list, shoot me an email or drop me a DM on twitter. Top 40 sorted by RS below

That is more than enough to start working through as we kick off trading tomorrow.

I hope everyone had a great holiday season and a happy new years.

Time to get back to work…

—NS